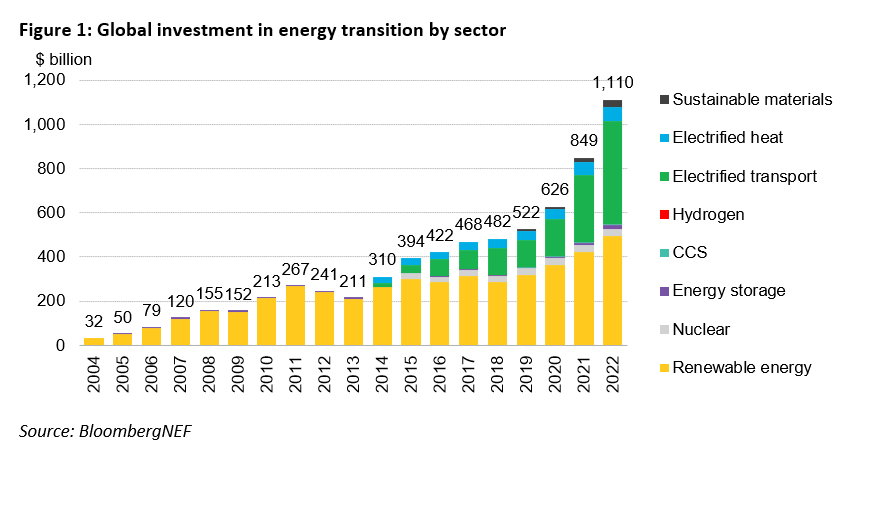

30th January 2023 Low-carbon energy technology investment exceeds $1 trillion For the first time, global investment in low-carbon energy technologies has exceeded $1 trillion and is now level with fossil fuels, according to a report by Bloomberg New Energy Finance (BNEF).

Worldwide investment in the low-carbon energy transition reached $1.1 trillion in 2022 – a new record and a huge acceleration from the year before – as the energy crisis and policy action drove faster deployment of clean technologies, according to a report from research firm BloombergNEF (BNEF). In another first, investment in low-carbon technologies appears to have reached parity with capital supporting fossil fuels. Energy Transition Investment Trends is BNEF's annual accounting of how much funding businesses, financial institutions, governments and end-users are committing to low-carbon technologies. Almost every sector covered in the report hit a new record level of investment in 2022 – including renewable energy, energy storage, electrified transport, electrified heat, carbon capture and storage (CCS), hydrogen, and sustainable materials. Only nuclear power investment did not set a record, staying broadly flat. Renewable energy, which includes wind, solar, biofuels, and other sources, remained the largest sector, achieving a new record of $495 billion committed in 2022, up 17% from the year prior. However, electrified transport, which includes spending on electric vehicles and their associated infrastructure, came close to overtaking renewables, with $466 billion spent in 2022 – an impressive 54% increase year-on-year. Hydrogen is the sector that received the least financial commitment, at just $1.1 billion (0.1% of the total), despite strong interest from the private sector and growing policy support. Hydrogen is, however, the fastest-growing sector with investment more than tripling over the year before.

BNEF's data shows that China was by far the leading country for attracting clean technology investment, accounting for $546 billion, or nearly half of the worldwide total. The US was a distant second at $141 billion, while the EU would have been second if treated as a single bloc, at $180 billion. Germany retained its third place, while the UK dropped one place to fifth as France climbed to fourth. Within the report, BNEF also makes a top-down estimate of global fossil fuel investments, including upstream, midstream, downstream and unabated fossil fuel power generation. This figure, arrived at independently for the purpose of comparison, is estimated at $1.1 trillion in 2022 – the same figure as the clean energy investment total. This marks the first time that clean technologies and fossil fuels have been at parity, and comes despite fossil investment growth triggered by last year's energy crisis. "Our findings put to bed any debate about how the energy crisis will impact clean energy deployment," said Albert Cheung, Head of Global Analysis at BNEF. "Rather than slowing down, energy transition investment has surged to a new record as countries and businesses continue to execute on transition plans. Investment in clean energy technologies is on the brink of overtaking fossil fuel investments, and won't look back. These investments will drive short-term job creation and help to address medium-term energy security objectives. But far more investment is needed to be on track for net zero in the long term." Despite these impressive results, global investment in low-carbon technologies remains woefully short of what is needed to address climate change. To get on a 2050 "net zero" CO2 emissions trajectory, such investment must immediately triple, BNEF estimates. Including the extra $274 billion invested in the power grid, energy transition investment hit $1.38 trillion in 2022. By comparison, the world must invest an annual average of $4.55 trillion for the remainder of this decade in order to get on track for net zero.

Comments »

If you enjoyed this article, please consider sharing it:

|