19th February 2025 U.S. insurance premiums to soar over next 30 years Due to climate-related risks, the United States could see a nearly $1.5 trillion reduction in unadjusted real estate value over the next 30 years, with insurance premiums rising by up to 322% above current levels by 2055.

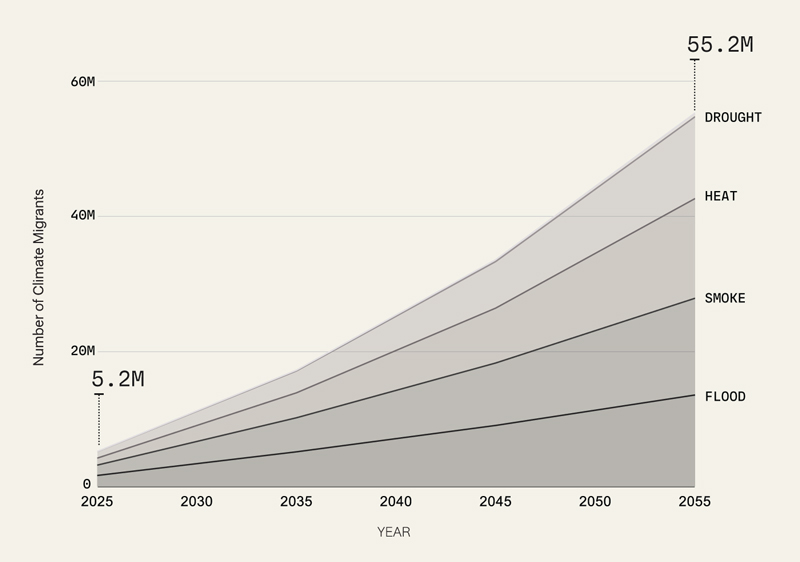

Throughout much of the last century, homeownership in the United States seemed like a dependable way to build wealth. However, a new report by risk analysis company First Street warns that surging climate disasters are pushing this model towards a critical juncture. By 2055, insurance premiums in some areas will soar to unprecedented levels, the report predicts – increasing the total cost of homeownership and eroding property values across vast swathes of the country. According to First Street's analysis, insurance premiums for residential properties are likely to rise by an average of nearly 30% nationwide. But the picture becomes far more dramatic in higher-risk coastal and flood-prone regions, where premiums may increase by several times the average. Miami's projected 322% rise stands out as the most alarming example, yet many other major metropolitan areas – such as Jacksonville (226%), Tampa (213%), New Orleans (196%), and Sacramento (137%) – also face steep hikes that could significantly impact homeownership costs. With each passing year, insurers continue to recalculate risk in response to greater storm frequency, damaging floods, searing heatwaves, wildfires, and other climate extremes, all of which drive up claims and pressure coverage availability. This re-pricing of risk also has knock-on effects for property values. First Street estimates $1.47 trillion in unadjusted real estate losses over the next three decades, as many neighbourhoods become harder to insure, and fewer buyers remain willing to shoulder the extra costs. Even inland areas once considered safe may be unable to escape these pressures. Record-setting wildfires in the West, persistent drought in parts of the Southwest, and increasingly destructive storms in the Midwest reveal that no region is immune to climate volatility. Recent extreme weather events foreshadow the growing cost of inaction. In 2024 alone, 27 billion-dollar disasters hit the United States, inflicting $182.7 billion in total damages. This is nearly double the annual average damage for the 2010s decade, nearly triple that of the 2000s decade, and 5.5 times the 1990s figure. As the world continues to warm, these catastrophes will intensify further, placing even greater strain on communities already in harm's way. Robust local economies can temporarily mask or absorb some financial shocks, but mounting insurance rates ultimately deter both individual buyers and institutional investors from high-risk locations. By 2055, First Street projects that the number of Americans voluntarily relocating within the country to avoid climate threats will exceed 55 million, a ten-fold increase compared to today. This shift in population will reshape local economies and magnify pressure on public services in both shrinking and growing regions. Land use patterns, infrastructure, and property taxes will see a seismic adjustment as people cluster in safer, less disaster-prone areas.

Given the magnitude of what lies ahead, a number of major property websites such as Realtor, Redfin, and Zillow have begun integrating climate risk data into their listings, helping prospective buyers factor insurance premiums and long-term vulnerability into their purchasing decisions. Since most U.S. mortgages have 30-year terms, property bought today may still be under repayment when the more severe impacts forecast for 2055 begin to materialise. Jeremy Porter, Head of Climate Implications Research for First Street, explained to CBS News how climate change is already affecting the insurance market with significant additional costs. "We're getting to the point where we can start to understand, at least from a climate component, what the additional cost of insurance is going to be," said Porter. "There will be other indicators that may also drive up insurance. But if we just isolate the climate component, we're able to understand how much more important climate is going to be in terms of pricing damages into the future. "Climate change is no longer a theoretical concern," he added. "It is now a measurable force reshaping real estate markets and regional economies across the United States. Our findings highlight the urgent need to understand how rising insurance costs and population movements are transforming the economic geography of the nation." "These results highlight not only the pressing challenges but also opportunities for adaptation and innovation in the face of climate change," said his colleague Matthew Eby, Founder and CEO of First Street, commenting on the report. "Policymakers, businesses, and communities must act now to mitigate risks and capitalise on the emerging economic opportunities in a shifting landscape." While the future projections may seem daunting, an increased awareness of climate risks can empower homeowners, businesses, and policymakers to respond. Local and federal initiatives – ranging from stricter building codes and improved flood defences, to smarter urban planning and enhanced wildfire management – can help mitigate future losses. As more data becomes available on property websites and through independent research, buyers and lenders alike can make decisions with greater clarity. Ultimately, the very same information that underscores the rising costs of inaction can galvanise innovation, adaptation, and more resilient communities in the decades ahead.

Comments »

If you enjoyed this article, please consider sharing it:

|

||||||