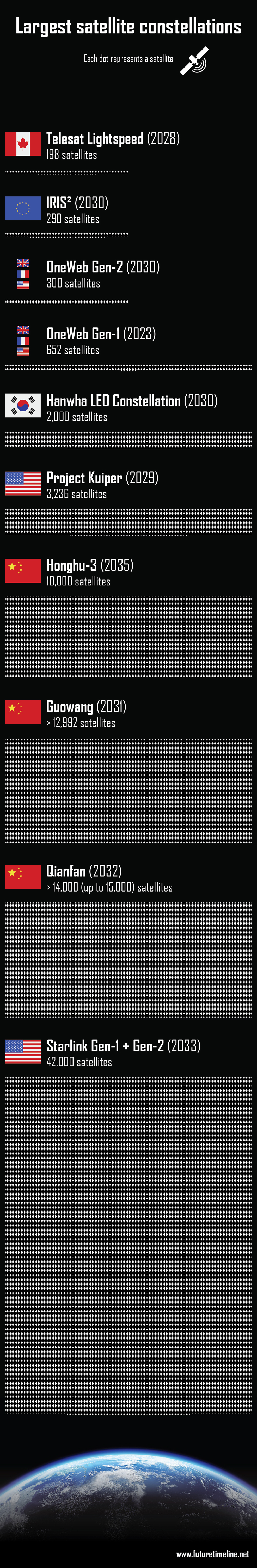

Largest satellite constellations In this feature, we cover the largest current and planned satellite constellations, in ascending order of size. From Telesat Lightspeed to Starlink, these networks are transforming global communications and the future of space.

In recent years, large satellite constellations have begun to transform near-Earth space. Back in 2019, when SpaceX launched the first batch of Starlink satellites, only about 2,000 operational satellites orbited the planet. Since then, that number has soared past 11,000, with plans now in place to exceed 100,000 by the end of the decade. While earlier constellations like Iridium and Globalstar laid the groundwork in the 1990s, they remained relatively small due to high launch costs and limited demand. Today, advances in reusable rockets and mass-produced spacecraft have turned scale itself into a key competitive advantage. Satellite constellations offer reliable Internet access to remote areas where fibre or mobile coverage is unavailable. They can help connect ships, aircraft, autonomous vehicles, and disaster zones, while also providing redundancy and resilience for national communications infrastructure. As governments and companies recognise the value of space-based broadband, a new global race is emerging – driven not just by technological ambition, but by geopolitical strategy. Among the largest and most ambitious networks are Starlink, Amazon's Project Kuiper, China's Guowang and Qianfan, and upcoming systems from South Korea and the European Union. These projects involve thousands – or even tens of thousands – of satellites operating in low-Earth orbit, supported by ever more powerful launch vehicles and sophisticated ground stations. The rapid expansion of these constellations is not without challenges, however. The exponentially growing number of satellites raises the risk of collisions, increases radio-frequency congestion, and interferes with ground-based astronomy. Space agencies and regulators are now under mounting pressure to enforce traffic rules and develop sustainable orbital practices. Despite these concerns, the benefits remain substantial. Large-scale satellite constellations have the potential to close the global digital divide, boost scientific and economic development, and provide critical infrastructure in times of crisis. The coming years will see not only continued growth of these networks – but also a growing responsibility to manage them wisely.

The largest satellite constellations, both current and future, are listed below in ascending order of size.

10. Telesat Lightspeed Satellites: 198 Completion: 2028 Operator: Telesat Country: Canada Telesat Lightspeed is a highly specialised broadband constellation designed for commercial, government, and defence markets. The system will feature a total of 198 satellites, combining both polar and inclined orbital planes, with 78 in near-polar orbits (1,015 km altitude) and 120 in inclined orbits (1,325 km altitude). Lightspeed prioritises high throughput and low latency, using advanced phased-array antennas and optical inter-satellite links to deliver 10 terabits per second (Tbps) of capacity. The Canadian government has backed the project with significant funding, and Telesat has secured manufacturing and launch contracts with partners such as MDA and Blue Origin. The constellation is expected to be fully operational by 2028.

9. IRIS² Satellites: 290 Completion: 2030 Operator: European Commission (with private partners) Country: European Union IRIS² (Infrastructure for Resilience, Interconnectivity and Security by Satellite) is the European Union's answer to Starlink and other emerging networks. Announced in 2022, with a projected cost of €10.5 billion, this constellation aims to safeguard European communications infrastructure, enhance cybersecurity, and promote digital inclusion. The satellites will be split into two groups: 18 operating in a medium Earth orbit (MEO) of 8,000 km, and the remainder in a low Earth orbit (LEO) of 1,200 km. They are being developed by a consortium of aerospace partners, including Airbus, Deutsche Telekom, and Thales Alenia Space. While IRIS² focuses heavily on secure government communications, it will provide additional services to eliminate connectivity "dead zones" in rural areas. Full deployment is expected by 2030, making it one of the EU's most ambitious space infrastructure projects.

8. OneWeb Gen-2 Satellites: 300 Completion: 2030 Operator: Eutelsat OneWeb Country: UK/France/USA OneWeb Gen-2 is a modest expansion of the existing OneWeb network. The initial plans, which had filed for 6,372 satellites, have since been scaled back to contain costs and improve the return on investment (ROI). The new satellites – now numbering 300 – will introduce better performance, higher capacity, and longer lifespans compared to Gen-1, with a more flexible architecture to meet evolving market demands. Launches are planned throughout the latter half of the 2020s, with full deployment expected by 2030. The Gen-2 network will reinforce Eutelsat OneWeb's position as a key player in global connectivity, particularly in aviation, enterprise, and maritime markets.

7. OneWeb Gen-1 Satellites: 652 Completion: 2023 Operator: Eutelsat OneWeb Country: UK/France/USA OneWeb's Gen-1 became one of the first serious competitors to SpaceX's Starlink. After experiencing financial turbulence in 2020, the company – now operating as Eutelsat OneWeb – rebounded with a successful deployment of 648 operational satellites (plus a few spares) by 2023. These spacecraft orbit at 1,200 km and deliver high-speed, low-latency broadband mainly for government and enterprise clients. Unlike Starlink, OneWeb avoids the direct-to-consumer market and focuses instead on partnerships with third-party connectivity providers. Its network provides mobile and fixed backhaul services, linking remote base stations and hard-to-reach locations to core networks where fibre or cable installations are impractical.

6. Hanwha LEO Constellation Satellites: 2,000 Completion: 2030 Operator: Hanwha Systems Country: South Korea Hanwha Systems, a major South Korean defence and aerospace firm, is planning a low Earth orbit (LEO) constellation of 2,000 satellites. The project aims to establish a national foothold in the growing space-based communications sector and reduce the country's dependence on foreign providers. Hanwha's entry into this market aligns with South Korea's broader ambitions to develop sovereign space infrastructure and become a serious player in the NewSpace economy. The constellation will support high-speed broadband across both domestic and international markets, with a particular emphasis on military-grade security. Hanwha has been investing heavily in satellite and launch technologies, including a strategic stake in the UK-based firm OneWeb and collaborations with other aerospace partners to develop its system architecture. While still in early stages compared to some of its competitors, Hanwha's LEO network represents one of the most ambitious satellite broadband projects in Asia outside China. If successful, it will place South Korea among the select group of nations operating large-scale constellations by the early 2030s.

5. Project Kuiper Satellites: 3,236 Completion: 2029 Operator: Amazon Country: United States Project Kuiper is Amazon's low Earth orbit (LEO) broadband initiative and one of the most ambitious challengers to SpaceX's Starlink. Approved by the Federal Communications Commission (FCC) in 2020, the network will comprise 3,236 satellites at full deployment. Its goal is to provide high-speed Internet to unserved and underserved communities worldwide, with a strong focus on affordability and flexible hardware options, including user terminals offering speeds of up to 100, 400, or even 1,000 megabits per second (Mbps), depending on the model. Amazon launched its first two prototypes in October 2023 and began deploying operational satellites in April 2025. Launches are likely to ramp up through the second half of 2025 and beyond. Service availability to consumers is expected once at least 578 satellites are in orbit. Amazon is developing custom user terminals and proprietary satellite technologies for enhanced performance and cost-efficiency. Launches are being carried out by multiple providers, including ArianeGroup, Blue Origin (owned by Amazon founder Jeff Bezos) and United Launch Alliance. Under its FCC license, Amazon must launch and operate half of its satellites no later than 30th July 2026, and the remaining satellites no later than 30th July 2029.

4. Honghu-3 Satellites: 10,000 Completion: 2035 Operator: HongQing Technology Country: China Honghu-3 is a megaconstellation planned by HongQing Technology, a Chinese company founded in 2017 and part-owned by commercial rocket-maker Landspace. While still at an early stage, this ambitious project is likely to add another 10,000 broadband satellites to China's growing presence in space by the mid-2030s, operating across 160 orbital planes. HongQing Technology filed its plans with the International Telecommunication Union in May 2024. Other details remain scarce, but reports suggest that the network may have military applications. With China's launch and manufacturing capacity rapidly expanding, Honghu-3 is poised to become a major part of the country's longer-term orbital ambitions, especially as global competition intensifies over space-based communications infrastructure.

3. Guowang Satellites: 12,992 Completion: 2031 Operator: SatNet Country: China Guowang is China's state-run answer to Starlink. The project is led by China SatNet, a government-owned company created in 2021, and forms part of a broader strategy to deliver secure communications, strengthen digital infrastructure, and reduce reliance on foreign networks. Guowang serves as a foundation for China's efforts to expand broadband coverage in rural regions and along Belt and Road Initiative corridors. Deployment began in December 2024 with the launch of 10 satellites and will ramp up substantially over the next few years, with almost 13,000 spacecraft expected to be operational by 2031, alongside the even larger Qianfan network (see below). Launch vehicles include the Long March 5B, Long March 12, and emerging commercial rockets such as Zhuque-3. Although primarily aimed at civilian broadband, Guowang's role in national security has drawn increasing attention from analysts. Its centralised state ownership and alignment with China's "civil–military fusion" strategy suggest potential support for defence-related communications.

2. Qianfan Satellites: >14,000 Completion: 2032 Operator: SSST Country: China Qianfan, also known as Thousand Sails, is a vast broadband satellite constellation led by Shanghai Spacecom Satellite Technology (SSST). Backed by the Shanghai Municipal Government and the Chinese Academy of Sciences, this network is being developed under a regional-commercial model, distinct from the more centrally controlled Guowang system. Qianfan began deployment in August 2024 and is expected to reach a key milestone of 648 satellites by the end of 2025. The project involves a combination of medium-lift and reusable launch vehicles, including the Long March 6A, Long March 8, and the methane-powered Zhuque-3 from commercial firm LandSpace. When completed in 2032, Qianfan will comprise more than 14,000 satellites operating across Ku, Q, and V frequency bands. This giant constellation will enhance China's domestic connectivity and serve as a key infrastructure element for the Digital Silk Road. Combined with Guowang and the newly emerging Honghu-3, China's three main constellations could deploy nearly 37,000 satellites in total – a figure that would closely rival the fully completed Starlink megaconstellation.

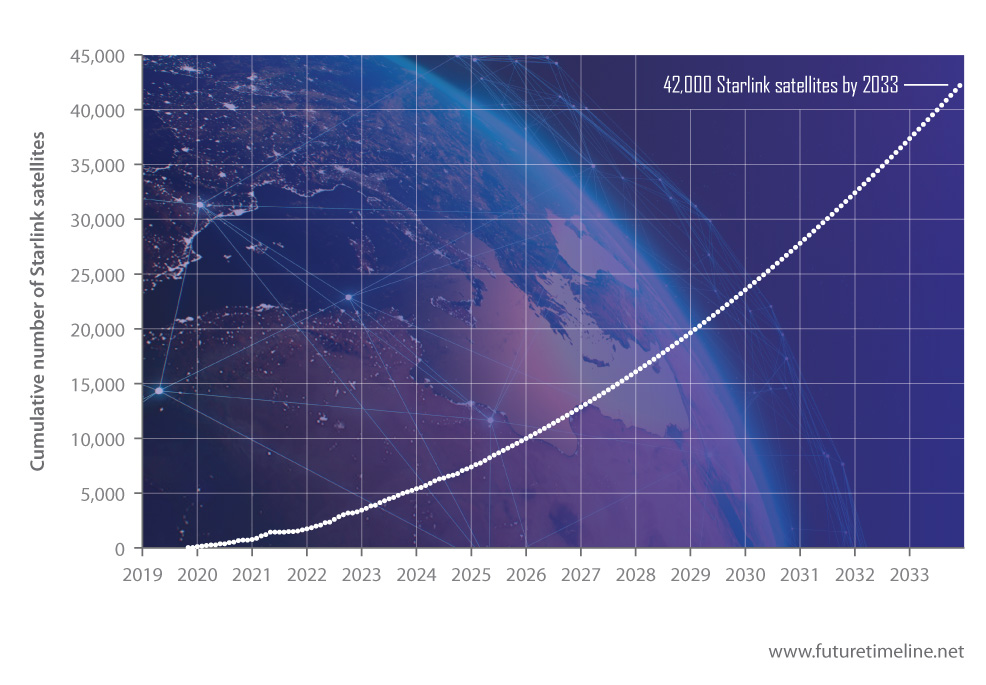

1. Starlink Gen-1 + Gen-2 Satellites: 42,000 Completion: 2033 Operator: SpaceX Country: United States Starlink is already the world's largest satellite constellation, designed and operated by SpaceX. Its goal is to provide low-latency, high-speed Internet to users around the globe, especially in remote or underserved regions. The first phase, Gen-1, began launching in 2019 and includes about 7,600 satellites (as of 2025). Gen-2 will significantly scale up the system with tens of thousands more, potentially reaching 42,000 by 2033. While the Gen-1 spacecraft are positioned at 550 km altitude, the newer Gen-2 satellites will operate between 340 km and 614 km. Phased-array antennas are already standard on Gen-1 satellites – both V1.0 and V1.5 – featuring multiple steerable beams for connecting to ground terminals. Laser (optical inter-satellite) links began appearing on the later V1.5 satellites and will be a key feature of Gen-2, improving data transfer and reducing reliance on ground stations. Launches for Gen-1 (including V1.0 and V1.5 designs) have occurred regularly aboard SpaceX's Falcon 9, which has been instrumental in building out the network thanks to its reusability. The newer Gen-2 satellites – initially deployed in the form of downsized "V2 Mini" versions – are also being launched via Falcon 9. SpaceX's massive Starship rocket is expected to support the later stages of Gen-2 deployment with full-sized V2 and V3 satellites, delivering much larger batches per mission. By the early 2030s, Starlink's infrastructure will include tens of thousands of satellites each offering up to 1 Tbps of downlink and 160 Gbps of uplink, more than 10x the downlink and 24x the uplink speed of the previous generation. Starship's enormous payload volume will enable up to 54 of these high-bandwidth spacecraft per flight, delivering more than 50 terabits per second into orbit at a time. The influence of this megaconstellation will extend from rural villages and polar expeditions to mid-ocean flights and remote islands, transforming Internet connectivity worldwide. Additionally, a Direct-to-Cell layer will provide seamless mobile coverage compatible with ordinary smartphones, largely eliminating terrestrial dead zones. However, Starlink's unprecedented scale and capacity – potentially accounting for a substantial percentage of global Internet traffic – has intensified debates around monopoly power, data privacy, national security, and the responsible use of low Earth orbit. Concerns regarding space debris management, collision risks, and interference with astronomical observations have prompted SpaceX to implement robust collision-avoidance systems and proactive de-orbiting measures. While Starlink represents a transformative leap in satellite Internet technology, its rise – alongside other emerging constellations – underscores the urgent need for stronger international coordination on space traffic management, long-term orbital stewardship, and equitable access. If managed with care, this new era of global connectivity could bridge the digital divide for billions, while setting important precedents for the future of near-Earth space.

Sources: Satellite constellation, Wikipedia:

Posted: 20th June 2025. Last updated: 20th June 2025.

If you enjoy our content, please consider sharing it:

|